What we learned at ‘Ramping Up: Unlocking the value in EV infrastructure investment’

What will it take to scale EV charging? Insights from our expert panel on the investment challenges and opportunities ahead.

Last week Steer hosted our event ‘Unlocking the value in EV infrastructure investment,’ the latest in our Ramping Up series which explores the state of the electric vehicle (EV) transition in Europe. The event, which took place in-person at our London office and online, saw a panel of experts from across the field of EV and investment tackling questions on finance for EV charging.

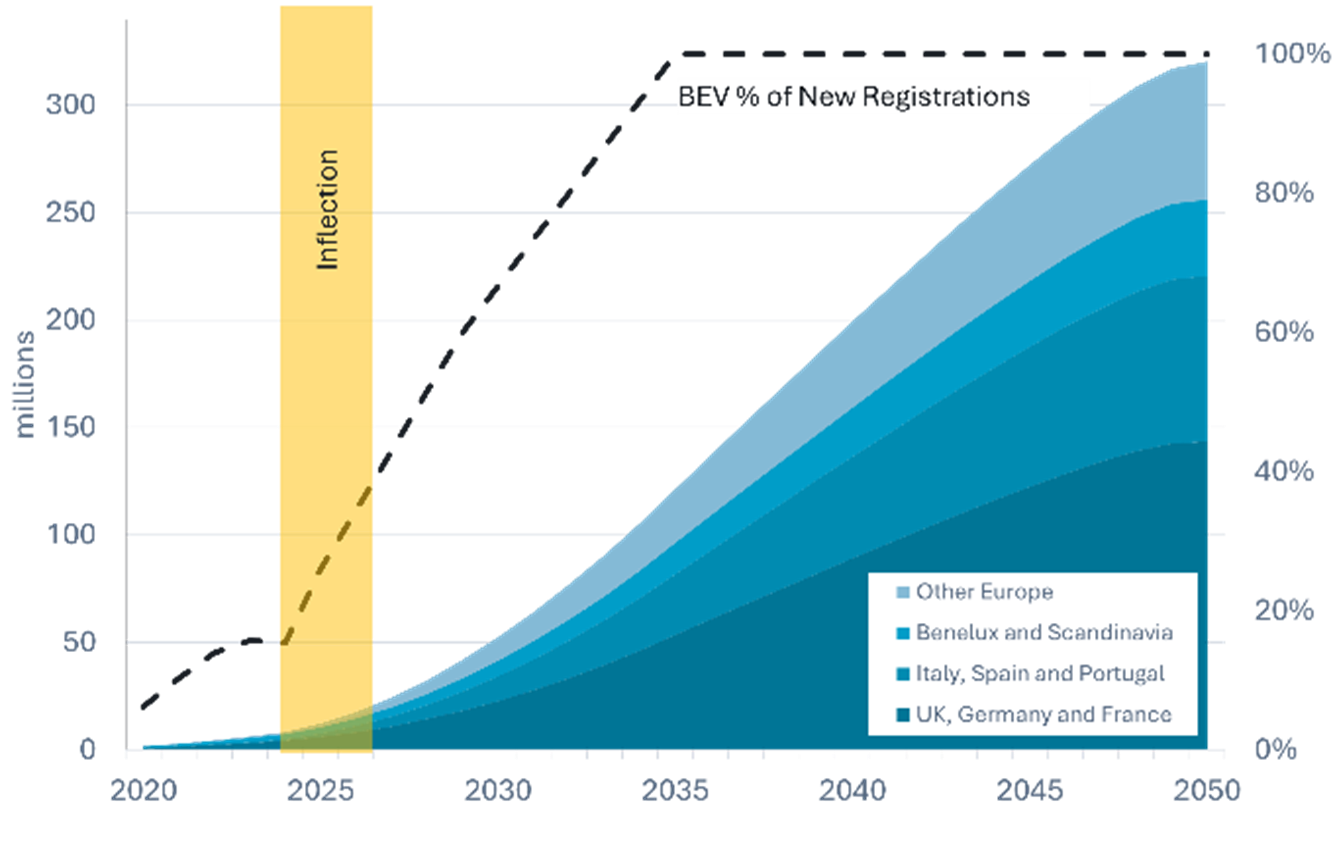

Europe is now at an inflection point in its transition to electric vehicles (EV). UK and EU legislation compels accelerating adoption of the new technology to an effective ban on the sale of anything but zero-emission vehicles by 2035 driving expansion of EV into our national car and van parcs like never before.

That transition to an EV future predictably drives demand for charging resources that serve drivers’ needs while yielding to attract private investment. How EV charging fits into the wider infrastructure landscape, how it’s evolved and what we anticipate in the coming years were all at focus in our panel of:

- David Scribner, Partner at Cameron Barney Herbst & Hilgenfeldt

- Priya Veerapen, Managing Director at Infracapital

- Julia Kowalle, Head of Asset Strategy, Global Structured Finance at SMBC

- Vicky Read, CEO at Charge UK

Key takeaways included:

The question is not whether the transition will happen, but when: All agreed that the mandated transition to EV is now irreversible. Despite that certainty however, investment depends on greater predictability as to where and when charging demand will emerge, the types of charging infrastructure drivers prefer and what they are willing to pay. While the early years of EV investment haven’t always met perhaps over-stretched expectations, renewed focus on both realised experience and more considered demand projections continues to fire investor enthusiasm for EV charging.

Is EV charging infrastructure: The panel debated whether charge points should be described as infrastructure when attracting specific investors. Unlike utilities, transportation assets and much of the built environment, EV charging can bear exposure to commercial risk. In response, the panel considered approaches more appealing to infrastructure and other investor groups.

Investment appetite correlates with operating risk: Though passing through an inflection point, EV charging is still in its infancy. Early investors have discovered the difficulty in anticipating when and where people will choose to charge. To capitalise on this fast-growing sector, more efficient investment may require much closer focus on associated commercial risk. Pairing charging with existing businesses featuring more predictable traffic (e.g., retail and transport) and enhanced focus on reliably captive demand such as freight, public transport and commercial vehicle operations can each mitigate commercial risk. Commercial risk may also be diluted by the diversification of public charging with income streams from private and depot charging.

Create a customer-centric experience: The panellists also agreed that investability rests on the operator’s laser-like focus on the customer experience of EV charging. Within a myriad issues around location selection, energy access, supply chain and build-out efficiency and others, charging projects enhance their investability by attracting more than their fair share of demand to expensive installed assets. Consistently offering reliable access to economically-priced energy at convenient locations is key, and it all has to “just work” to attract and retain loyal customers.

This was a terrifically useful panel discussion for our in-house and on-line audiences and we appreciate the generous participation of our panellists David, Priya, Julia and Vicky.