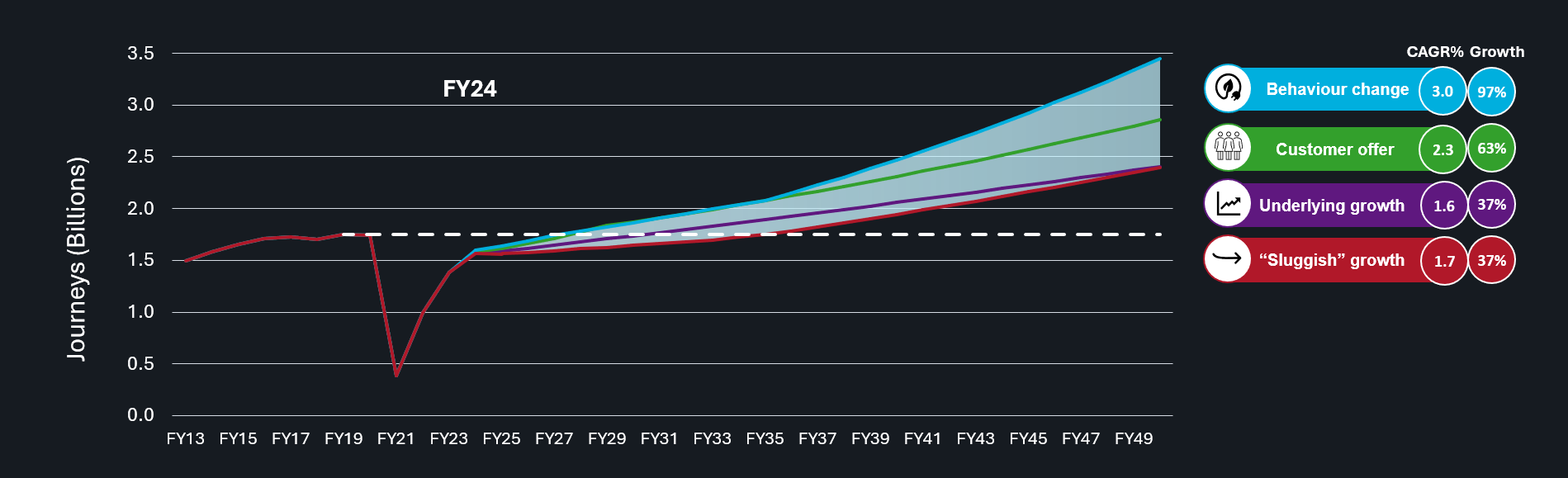

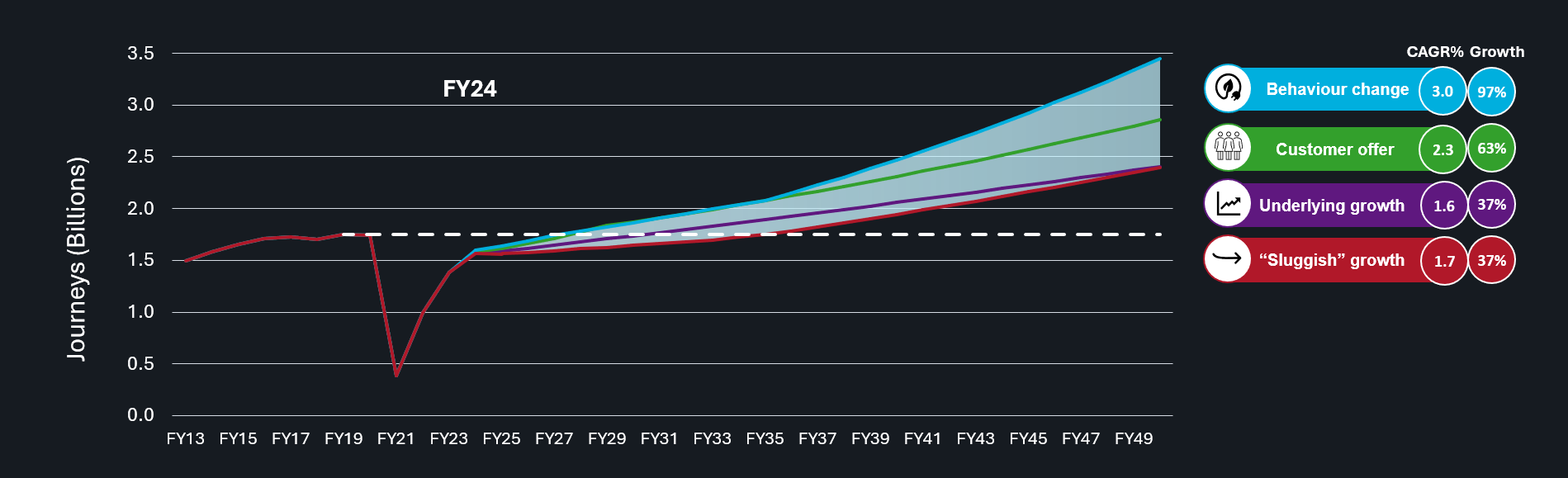

Last year, Steer developed scenarios demonstrating the potential for future growth in GB rail passenger demand. Those scenarios indicated that by 2050, GB rail could be carrying 97% more passengers in 2050 than in 2019 – equivalent to nearly 5 million extra passenger journeys per day.

Demand growth in the last 18 months has been in line with that most optimistic scenario, with rail passenger demand growing by 16% in 2023/24, and a further 8% in the first half of 2024/25.

But we also identified that half of this growth was derived from significant industry change – the extraordinary growth on the Elizabeth Line, and the reduction in industrial action – which the railway will not be able to rely on for growth going forward. However, growth at 8% this year continues to be above historic long-term annual rates of growth for passenger rail in Britain.

Our conclusion is that continuing weak expectations for economic growth, reducing costs of car usage and pressure on the industry’s key cost drivers mean targeted industry focus is now required to grow revenue and demand.

What does the data tell us about future opportunities?

With more and more powerful data going into the public domain, we have been able to draw powerful insight into the current landscape for rail travel, and what it means for rail demand in the future.

ORR’s Origin-Destination Matrix, produced by Steer for the last 10 years and now available on the Rail Delivery Group’s Rail Data Marketplace, shows some rail markets thriving (Scotland-London up 36% on pre-pandemic demand), whilst others lag behind. Learning what has worked well, and what hasn’t, in driving demand offers significant opportunity for “levelling up” demand growth across the country.

Markets historically reliant on commuter patronage are, as a result of the hybrid working model accelerated by the pandemic, unsurprisingly struggling to recover. Whilst strong midweek demand continues to dictate capacity requirements, there are 000s of spare seats on Mondays and Fridays that we continue to struggle to fill. However, evidence from both Scotland and London fare pilots shows that price – the strongest lever for targeted intervention – is not a financially sustainable way to drive up profitable demand in these markets.

But some customer behaviour did change in these trials. It is imperative that the industry finds ways to identify customers who can be influenced, and then builds targeted offers to meet their specific needs.

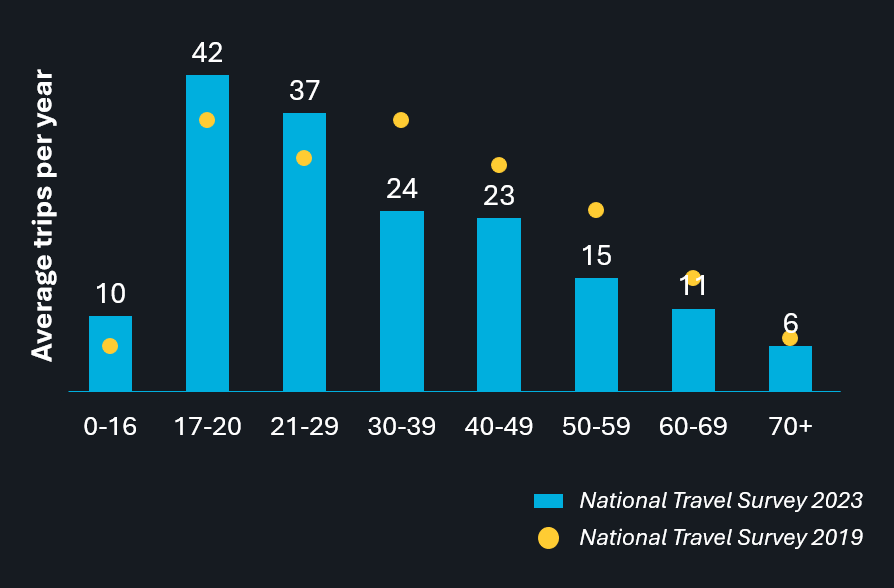

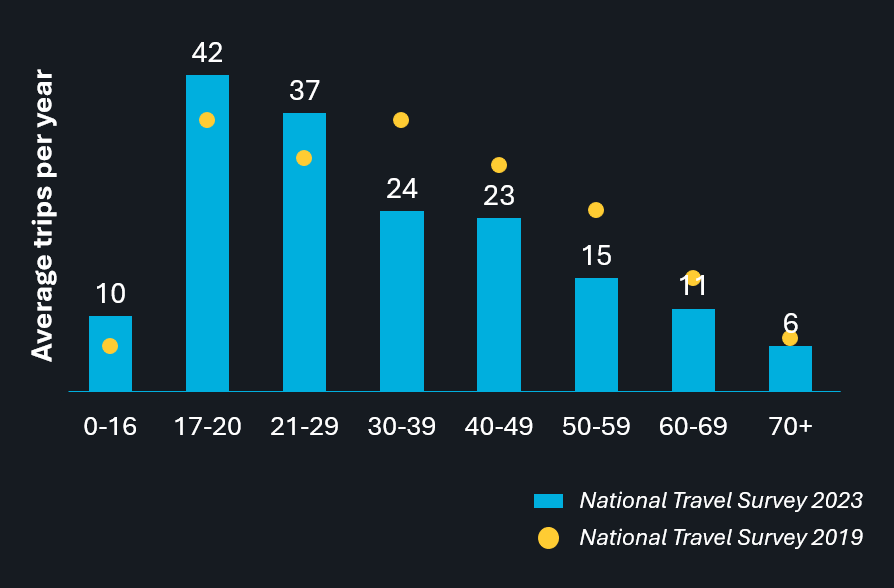

So where to find them? It is pertinent that DfT’s National Travel Survey shows us that younger passengers are travelling more often by rail than before the pandemic. It is imperative that we engage with them directly and shape the railway of today and tomorrow with an understanding of their needs, to ensure the railway has a (financially) sustainable future.