Who Will Be Investing in the Future of EV Charging?

As demand for EVs grows, where will the next wave of investment in charging infrastructure come from — and what will it take to attract it?

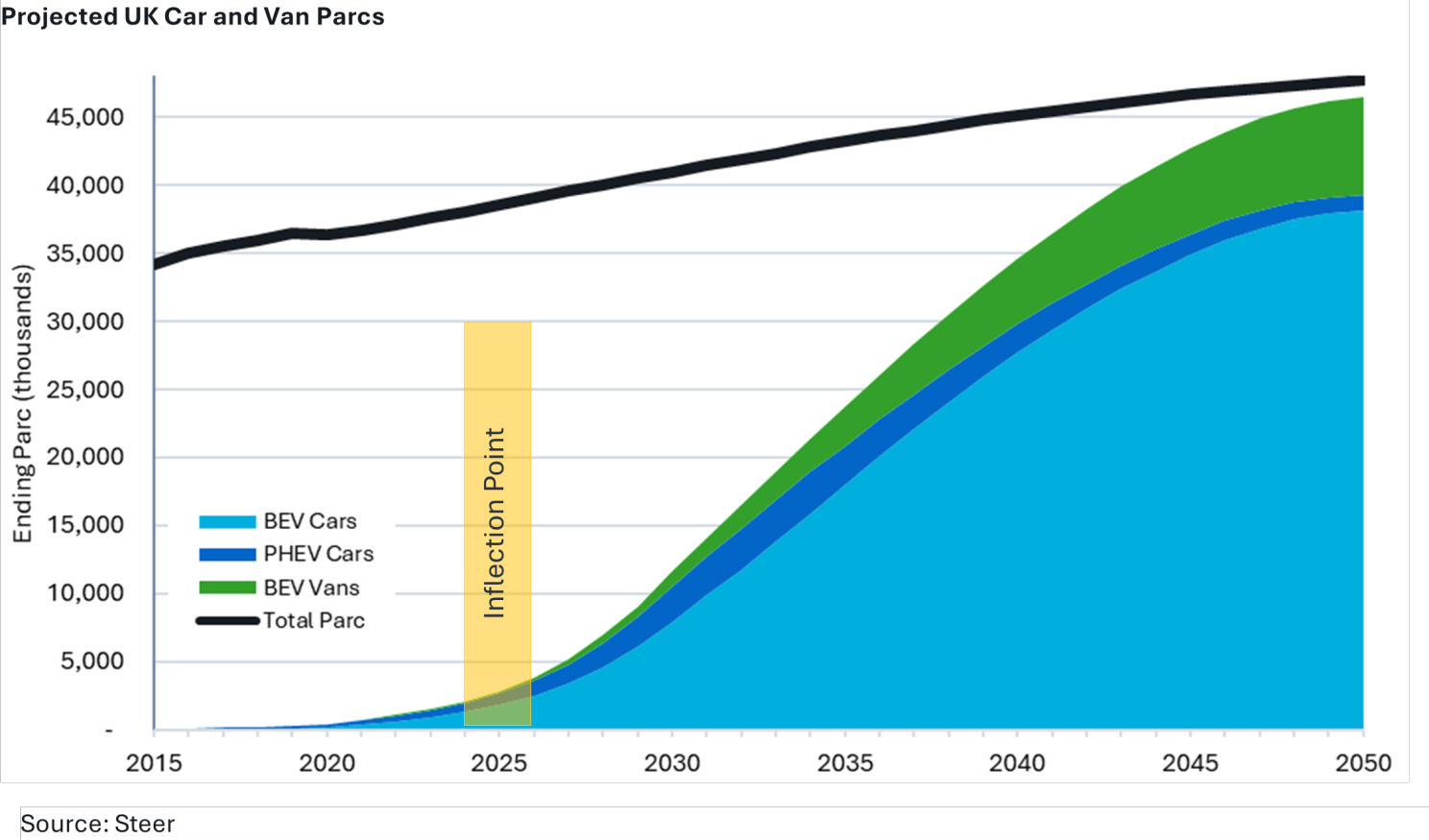

Last month, Steer hosted our Ramping UP event in which we looked at the future funding of EV charging with a panel of investors, lenders, bankers and ChargeUK, the representative body for the UK’s chargepoint operators (CPO). In commenting on the investability of EV charging, we acknowledged that the terms of the ZEV Mandate define an inflection point, after which the pace of EV adoption.

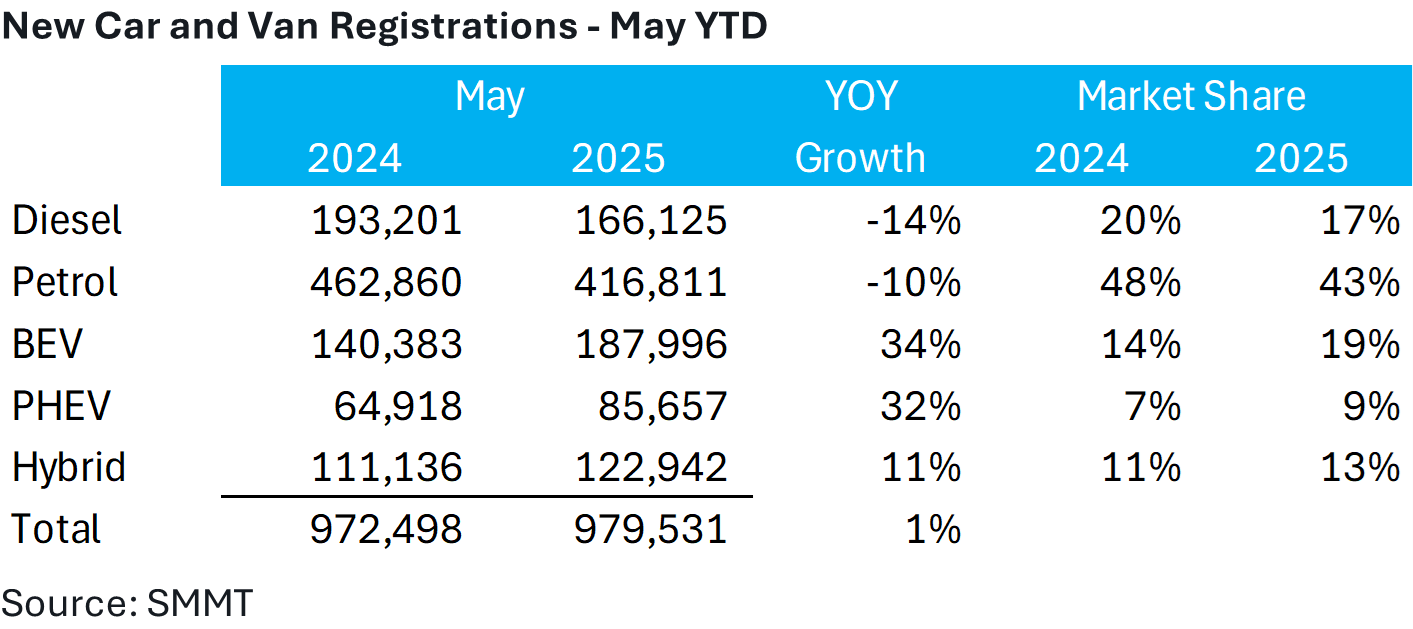

The pace by which drivers adopt battery electric (BEV) and plug-in hybrid electric (PHEV) is critical to investors considering opportunities in EV charging as it defines the demand that yields returns on investment. Even when considering proposed flexibilities by which manufacturers will comply with the regulation, the ZEV Mandate and comparable CAFE standards in Europe make the projection of expanding demand far more predictable. Already in the first 5 months of this year, the Society of Motor Manufacturers and Traders (SMMT) indicates that penetration of BEV/PHEV within new car and van sales (the object of the ZEV Mandate) has risen by more than 30% over last year's figures.

Pounds and Pence

I estimate that our existing 80,000-strong network of public chargers has cost about £1.5 billion, largely funded by energy companies (BP, Shell, Total and EDF, etc.) and financial investors, notably including Infracapital, KKR, Aviva Investors, Zouk Capital LLP, National Wealth Fund, Meridiam, BlackRock and others.

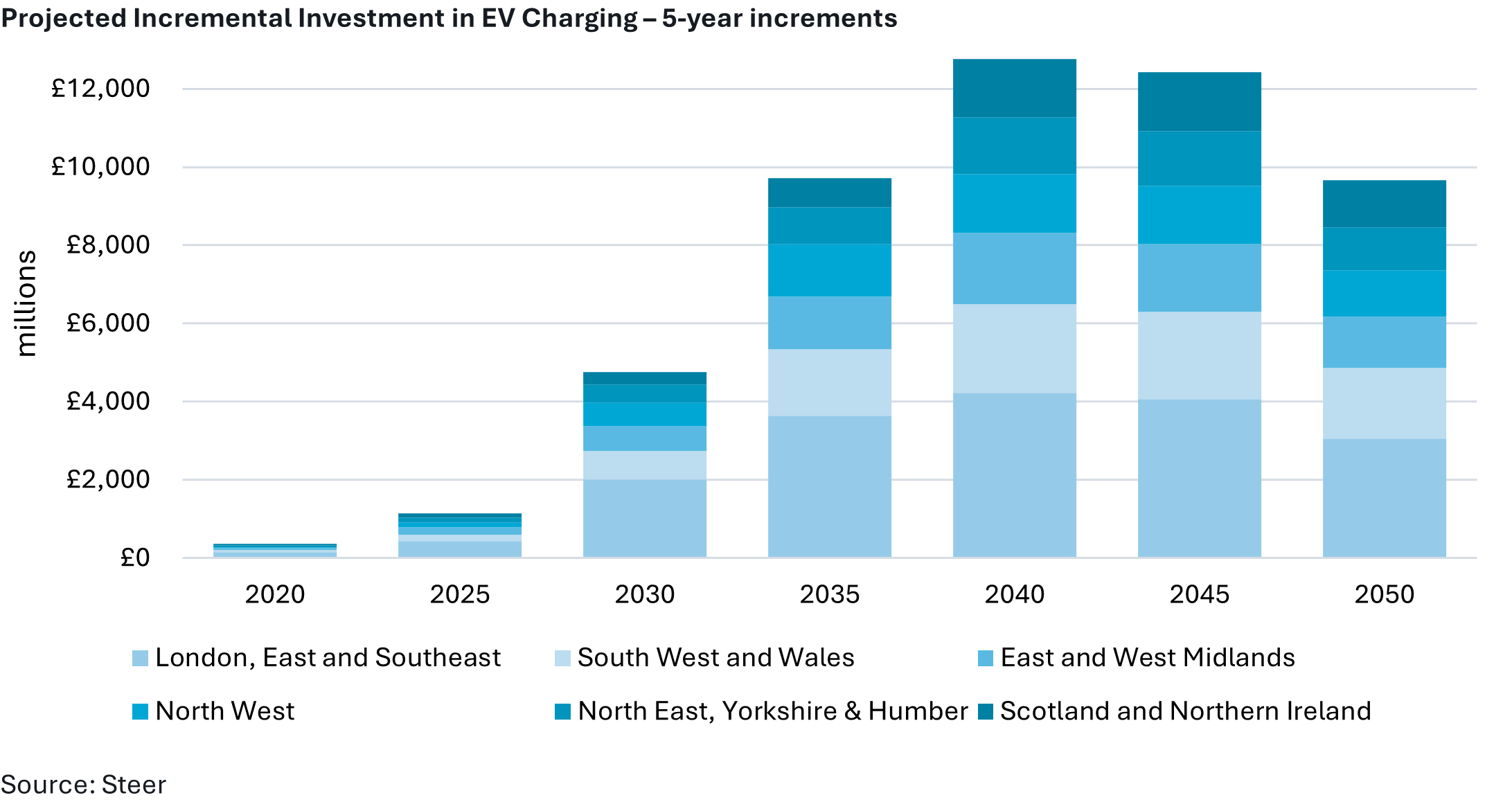

As a function of the expanding BEV and PHEV parcs, I further estimate that expansion of the public charging network required to accommodate energy demand across the UK will call for:

- Another £5 billion by 2030,

- Yet another £10 billion in the five years thereafter and

- Subsequent 5-yearly investments of £10 to £12 billion thereafter through 2050, when we approach 100% parc electrification.

Where's the Money?

To date, investment has generally been in CPOs who secure individual operating permissions, build out and operate charging facilities and then steward portfolios of revenue generating assets. This may not ultimately prove to be the most efficient investment channel and we should anticipate an evolution better driving investment to returns.

However, the fundamental question remains, from where will incremental investment come? Some of the £5 billion required through 2030 can already be identified:

- Existing CPO demonstrate a certain amount of cash available on their balance sheets for investment.

- Over the past few years, we've seen a number of CPOs raising substantial pots of additional capital. Believ, GRIDSERVE , Motor Fuel Group and Aegis Energy have all recently secured debt and equity raises from new and existing investors, each in excess of £100 million and many more demonstrate smaller capital raises including those several supported by Zouk Capital LLP via the CIIF fund.

- Those CPOs associated with much larger parent companies (i.e., bp pulse, Shell Recharge Solutions, the partnership between Total and SSE that now operates Source London, EDF, Norwegian Statkraft, etc.), all enjoy access to growth capital within their corporate structures.

- The UK's local EV infrastructure program (LEVI) presents about £350 million of committed subsidy.

Conclusion

In big round numbers, these four buckets might total £2 to £3 billion on top of the £1.5 already in the ground. We're still left with the question of who will bring new money into the sector.

Ultimately, we must acknowledge that investment follows returns. Government mandated expansion of EV adoption irresistibly and predictably drives growth in demand that yields return on installed chargepoints. While investor interest in any specific project relies on a thorough understanding of the service delivery model, the customer segments served and the predictability of expected cash flows, it feels safe to anticipate that there will emerge new investment with appetite for the panoply of offered opportunities. Our industry's obligation, therefore, is to define offered opportunities to a level of detail that we may not have seen yet.